Free Suggestions For Choosing Credit Card Apps

Wiki Article

What Behaviour Is Deemed To Be Suspicious And Could Cause A Card To Be Blacklisted?

A variety of behaviors or activities could trigger red flags and could may be deemed suspicious, leading to a credit card being flagged or blocked by the issuer of the card or a financial institution. Examples of suspicious behaviour are: Unusual Spending Patterns-

The suspicion may be triggered by purchases that are large or sudden increases in expenditure compared to cardholders' usual behavior.

Unrecognized Transactions

It is possible to commit fraud if statement of the cardholder shows transactions that are unauthorised or not approved.

Multiple Declined Transactions

Multiple declined or failed transactions within a short time period, especially in the event that a cardholder typically has a history of positive transactions may indicate an problem.

Geographic Anomalies

Transactions that originate from locations far from the usual spending area or multiple transactions from different geographical locations within a brief time can raise suspicion.

Certain types of purchases are abnormal

There is a way to flag purchases that are suspicious. This can include high-value purchases that do not fit with the cardholder’s usual spending habits.

Uncommon Online Behavior

Unexpected online activity, such as multiple failed log-ins, changing account information or unusual attempts to login could signal an unauthorized access.

Unusual Card Use

When a card's normal use pattern is disrupted the card could be deemed suspicious. For example, if a local credit card suddenly becomes used for international transactions.

Rapid Cash Advances or Transfers-

Cardholders might receive notifications for advance or cash transfer that are not in line with their normal spending habits.

Frequent Card Not Present Transactions

An increase in the number of transactions using a card that is not present (online or by phone) without a previous background could be an indication of fraud.

Issues with Identity Verification-

Suspicion could arise if there are difficulties in confirming the cardholder’s identity, especially when additional verifications are needed.

These actions, along with others, may cause the card issuer's fraud detection systems or monitoring mechanisms, prompting them to investigate, and eventually block the card temporarily until the cardholder's identity is established or the legitimacy of transactions is confirmed.

What Does Being Blacklisted Signify?

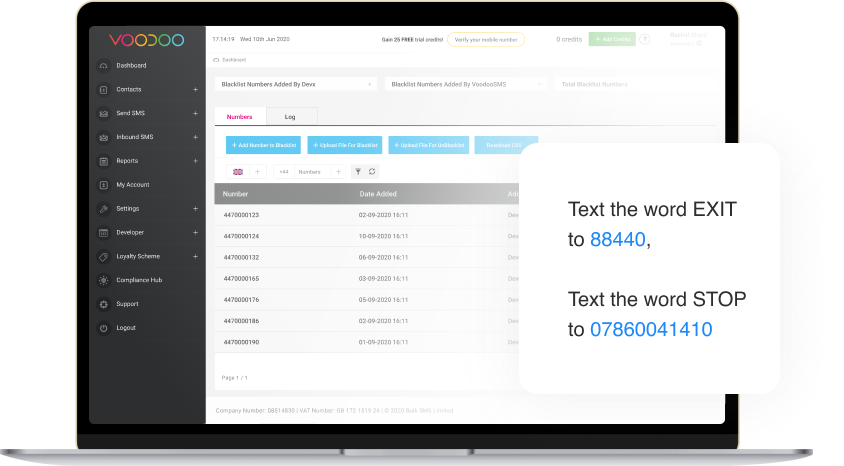

Being on a Blacklist can limit the use of a card or transactions until the issue is addressed. There are many different reasons why a credit card may be put on a blacklist.

Card Blocked for Security Reasons If you suspect that your card is being used for fraud, your card may be blocked if it detects unusual or suspicious transactions.

Security Issues If there is an indication of a potential breach, such as an unauthorised access, a data leak involving card details or unusual patterns of spending, the card may be tagged.

Issues with Identity Verification - If you have difficulty in proving the identity of your cardholders during transactions, particularly in cases where additional verification is required your card could be temporarily blocked.

The card was stolen or lost. Card- If the card is reported stolen or lost by the cardholder, the issuer might apply a block to the card to stop the card from being used in a way that is not authorized until a replacement card can be issued.

Suspicious Activity Indicators- Any actions or behavior connected to the card is suspicious, such as numerous declined transactions, geographical irregularities, or unusual spending patterns, could trigger a temporary block.

Cardholders could be denied using their cards for purchases or accessing credit when they are listed on an blacklist. This is until the card issuer can confirm the legitimacy of the card or solve any issues relating to security or fraud. It's essential for the cardholder to contact the issuer promptly to address the issue, confirm the validity of transactions, and deal with any security concerns that may be that may be associated with the card.

Cybersecurity Experts Are Trained To Monitor And Identify Cyber-Attacks, Including Credit Card Information.

Security professionals employ a variety of methods, tools, and strategies to monitor and detect cyber-attacks, which includes compromised credit card information. A few common practices and techniques are: Threat Intelligence Gathering

Gathering information from diverse sources, such as forums such as dark-web monitoring, forums, feeds and security advisory to keep current on the latest threats and security vulnerabilities.

Network Monitoring and Intrusion DetectionNetwork Monitoring and Intrusion Detection

Check the traffic on your network using specific software or tools. Look for suspicious or unusual behavior that may indicate unauthorised access or breaches of data.

Vulnerability Assessments and Penetration Testing

Conducting regular checks to detect weaknesses in systems, applications or networks. Penetration testing involves simulated attacks to find vulnerabilities and assess your organization's cybersecurity capabilities.

Security Information and Event Management (SIEM)--

Implementing SIEM solutions to aggregate and analyze logs from various sources, such as servers and firewalls, to identify and respond to security issues immediately.

Behavioral Analytics-

Use behavioral analysis to detect abnormal patterns or deviations in user behavior, within systems or networks. This could indicate the possibility of a breach.

Threat Hunting

Proactively searching for signs of threats or suspicious activities within an organization's network by analyzing logs, traffic, and system information to identify potential threats that may have evaded traditional security measures.

Endpoint Security Solutions-

Use endpoint security (such anti-malware programs such as endpoint detection tools, endpoint detection tools, response tools and others.) to protect devices and endpoints from malicious activities.

Encryption of Data and Data Protection

Implementing encryption technologies to safeguard sensitive information, including credit card information at rest and in transit and at rest to reduce the chance of security breaches.

Incident response & Forensics

Implementing an incident response plan will enable you to swiftly respond to any incidents. Conducting forensics analysis to understand the extent, impact, and the root cause of security incidents.

Cybersecurity specialists combine these approaches and a deep understanding with the latest regulations and best practices to identify, minimize and respond quickly to cyber-attacks. To ensure a strong defense against cyber-attacks it's essential to be on top of the latest monitoring, analysis and an active approach. Follow the top rated savastan for more examples.